Warranty Expense On Balance Sheet . effect on balance sheet. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. If a seller can reasonably estimate the amount of warranty claims likely to arise. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. Units sold, the percentage that will be replaced within the. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. On the balance sheet, the initial recognition of warranty liabilities increases the total. overview of warranty accounting. to record the warranty expense, we need to know three things:

from www.chegg.com

to record the warranty expense, we need to know three things: a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. On the balance sheet, the initial recognition of warranty liabilities increases the total. Units sold, the percentage that will be replaced within the. effect on balance sheet. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. If a seller can reasonably estimate the amount of warranty claims likely to arise. overview of warranty accounting.

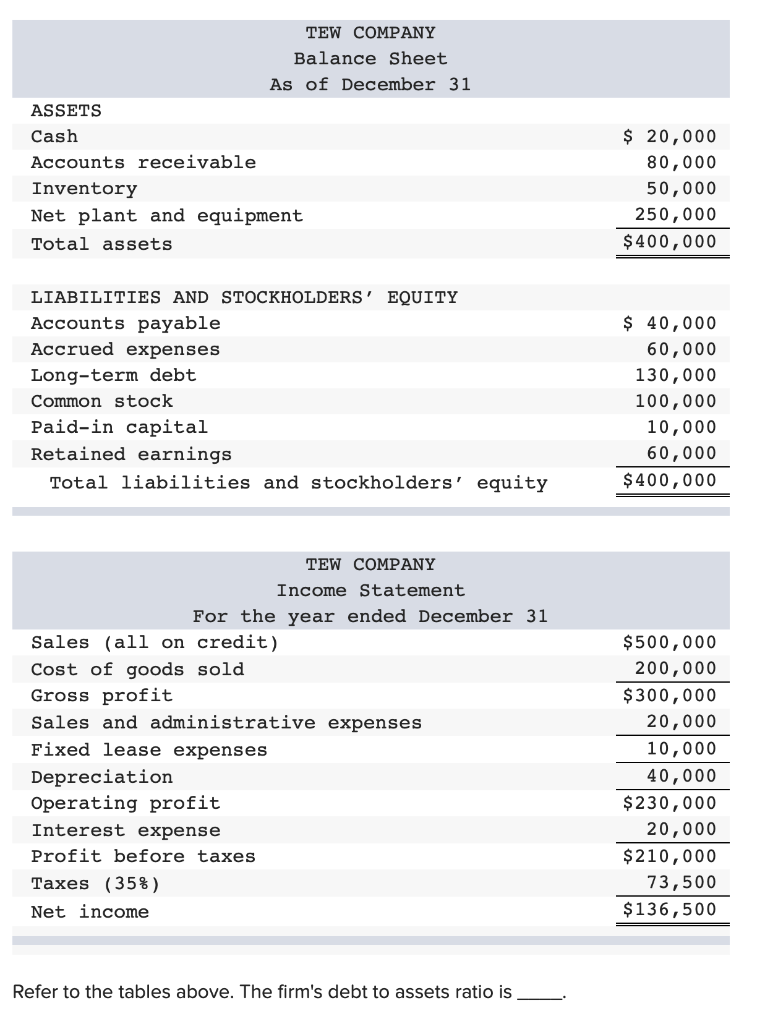

Solved TEW COMPANY Balance Sheet As of December 31 ASSETS

Warranty Expense On Balance Sheet warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. Units sold, the percentage that will be replaced within the. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. to record the warranty expense, we need to know three things: therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. If a seller can reasonably estimate the amount of warranty claims likely to arise. On the balance sheet, the initial recognition of warranty liabilities increases the total. overview of warranty accounting. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. effect on balance sheet.

From www.educba.com

Accrued Expense Examples of Accrued Expenses Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: overview of warranty accounting. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. Units sold, the percentage that will be replaced within the. warranty expense is the cost that a business. Warranty Expense On Balance Sheet.

From www.template.net

21+ Free Expense Sheet Templates Warranty Expense On Balance Sheet warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. to record the warranty expense, we need to know three things: If a seller can reasonably estimate the amount of warranty claims likely to arise. a warranty expense involves costs related to repairing, replacing, or compensating customers. Warranty Expense On Balance Sheet.

From spscc.pressbooks.pub

LO 11.3 Define and Apply Accounting Treatment for Contingent Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. overview of warranty accounting. effect on balance sheet. If a seller can reasonably estimate the amount of warranty claims likely to arise. warranty expense. Warranty Expense On Balance Sheet.

From www.spendesk.com

Definition & Types of Expense Accounts Spend Management Glossary Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: If a seller can reasonably estimate the amount of warranty claims likely to arise. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. therefore, a company must record in the period of the sale the. Warranty Expense On Balance Sheet.

From quiznutritions.z13.web.core.windows.net

How To Calculate Warranty Expense Warranty Expense On Balance Sheet If a seller can reasonably estimate the amount of warranty claims likely to arise. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. overview of. Warranty Expense On Balance Sheet.

From www.scribd.com

Acc. Assignment 1 Tonushree PDF Expense Balance Sheet Warranty Expense On Balance Sheet On the balance sheet, the initial recognition of warranty liabilities increases the total. Units sold, the percentage that will be replaced within the. effect on balance sheet. overview of warranty accounting. to record the warranty expense, we need to know three things: If a seller can reasonably estimate the amount of warranty claims likely to arise. . Warranty Expense On Balance Sheet.

From www.googlesir.com

Balance Sheet Format Explained (With Examples) Googlesir Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. If a seller can reasonably estimate the amount of warranty claims likely to arise. overview of warranty accounting. On the balance sheet, the initial recognition of. Warranty Expense On Balance Sheet.

From www.wordmstemplates.com

17 Balance sheet Templates Excel PDF Formats Warranty Expense On Balance Sheet therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. to record the warranty expense, we need to know three things: If a seller can reasonably estimate the amount of warranty claims likely to arise. overview of warranty accounting. Units sold, the percentage that. Warranty Expense On Balance Sheet.

From warrantyweek.com

Warranty in Financial Statements, 30 July 2009 Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. On the balance sheet, the initial recognition of warranty liabilities increases the total. warranty expense is the cost that a business expects to or has. Warranty Expense On Balance Sheet.

From www.educba.com

Warranty Expense Warranty Expense Tax Treatment Warranty Expense On Balance Sheet warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. overview of warranty accounting. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. to record the warranty expense, we need to know. Warranty Expense On Balance Sheet.

From exonqyhgf.blob.core.windows.net

What Are Expenses On A Balance Sheet at Corey Durant blog Warranty Expense On Balance Sheet On the balance sheet, the initial recognition of warranty liabilities increases the total. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. overview of warranty accounting. effect on balance sheet. to record the warranty expense, we need to know three things: Units. Warranty Expense On Balance Sheet.

From www.youtube.com

Warranty Liability (Journal Entries) YouTube Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: effect on balance sheet. On the balance sheet, the initial recognition of warranty liabilities increases the total. in this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an. a warranty expense involves costs related to. Warranty Expense On Balance Sheet.

From www.youtube.com

Accounting for Warranty Expense and Warranty Payable YouTube Warranty Expense On Balance Sheet On the balance sheet, the initial recognition of warranty liabilities increases the total. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. Units sold, the percentage that will be replaced within the. in this journal entry, warranty expense is recorded as an expense item on the income. Warranty Expense On Balance Sheet.

From www.formsbirds.com

Balance Sheet Example 5 Free Templates in PDF, Word, Excel Download Warranty Expense On Balance Sheet therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. If a seller can reasonably estimate the amount of warranty claims likely to arise. On the balance sheet, the initial recognition of warranty liabilities increases the total. in this journal entry, warranty expense is recorded. Warranty Expense On Balance Sheet.

From spscc.pressbooks.pub

LO 11.3 Define and Apply Accounting Treatment for Contingent Warranty Expense On Balance Sheet therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. If a seller can reasonably estimate the amount of warranty claims likely to arise. to record the warranty expense, we need to know three things: overview of warranty accounting. a warranty expense involves. Warranty Expense On Balance Sheet.

From www.scribd.com

Balance Sheet Expense Net Warranty Expense On Balance Sheet If a seller can reasonably estimate the amount of warranty claims likely to arise. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. effect on balance sheet. On the balance sheet, the initial recognition of warranty liabilities increases the total. to record the warranty expense, we. Warranty Expense On Balance Sheet.

From www.chegg.com

Solved TEW COMPANY Balance Sheet As of December 31 ASSETS Warranty Expense On Balance Sheet to record the warranty expense, we need to know three things: On the balance sheet, the initial recognition of warranty liabilities increases the total. Units sold, the percentage that will be replaced within the. If a seller can reasonably estimate the amount of warranty claims likely to arise. warranty expense is the cost that a business expects to. Warranty Expense On Balance Sheet.

From www.scribd.com

Chapter 2 PDF Expense Balance Sheet Warranty Expense On Balance Sheet warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. On the balance sheet, the initial recognition of warranty liabilities increases the total. a warranty expense involves costs related to repairing, replacing, or compensating customers for product flaws, with provisions for estimated future. If a seller can reasonably. Warranty Expense On Balance Sheet.